Late payment: A mental health as well as financial impact on small business owners

Posted: Sat 13th Jul 2019

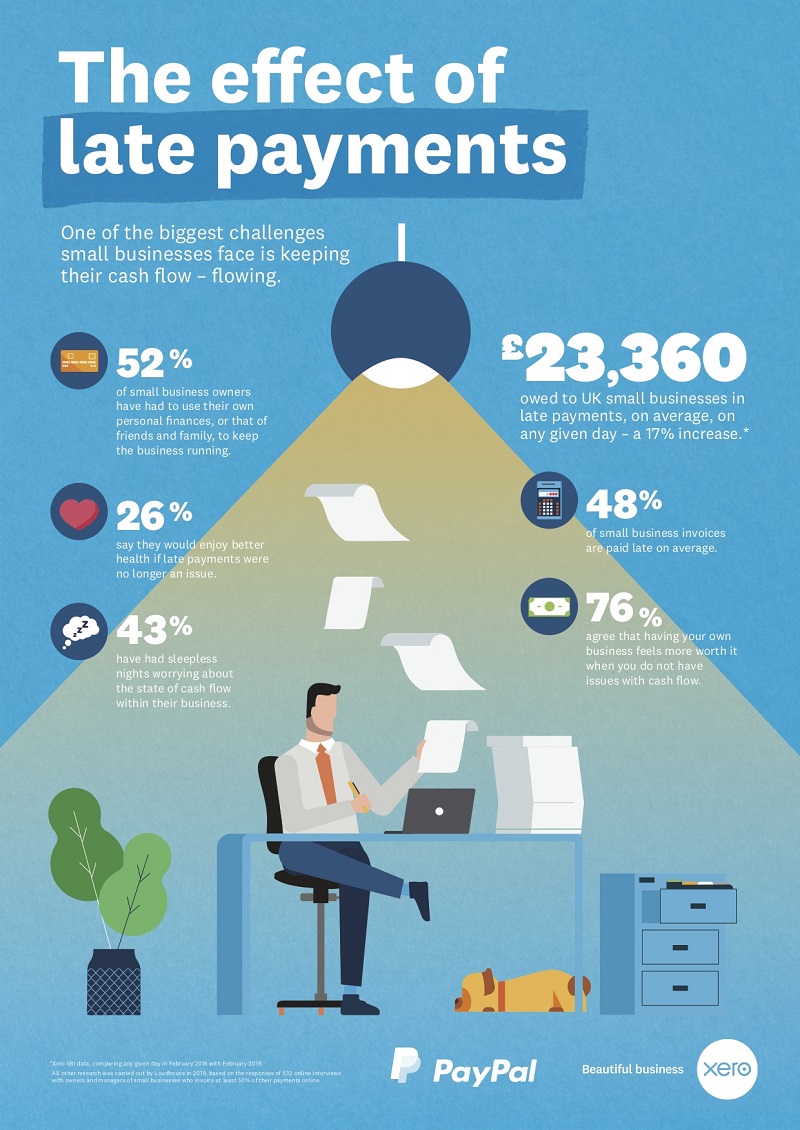

The financial impact on small business owners of dealing with overdue invoices is often talked about but new research has found that more than two fifths of small business owners say it has also affected their mental health.

The issue has got so bad for some that 37% of entrepreneurs have considered giving up their businesses entirely because of cash flow issues over the last 12 months, according to the report by Xero and PayPal.

The impact of late payment on happiness

The survey also questioned business owners about how they would feel if cash flow was no longer an issue.

More than three quarters said having a business would feel more 'worth it', and 73% would feel more optimistic about their business. Another 26% believe they would enjoy better physical health.

Dr Nick Taylor, CEO at wellbeing app Unmind, said: "The brain is the most complex part of the body, yet we often don't give it the full care and attention it deserves. There's a stigma around how we discuss mental health. But mental health is a spectrum.

Most small business owners will find themselves at different points along that spectrum at different times in their lives, depending on various factors such as stress, genetic predisposition and diet. This is why nourishing our brains is so important."

The findings showed the scale of the late payments challenge facing British small businesses, who it said are owed an average of £23,360 in overdue invoices on any one day and have to wait on average 14 days after the due date to be paid.

The amount owed to small businesses in late payments in February 2019 was up 17% from the year before.

On average in any given month, 48% of invoices issued by small businesses are paid late which leaves 26% of company owners struggling to pay their own suppliers on time.

Gary Turner, co-founder and managing director at Xero, said: "Late payments don't just damage business finances and relationships; they can compromise personal finances and relationships.

"Our research illustrates how getting paid on time can have a dramatic effect on a small business owner's happiness. When they struggle, the whole of the UK struggles."

Nicola Longfield, director of Small and Medium Business at PayPal UK, added: "For small businesses looking to grow, time and money are paramount.

"Late payments sap both and prevent a business owner from investing in the technology, staff or stock needed to sustain and grow their business."

Big firms face fines for not paying on time

The government recently announced it is considering new proposals that would see big companies hit with financial penalties for not paying smaller suppliers on time.

Under the proposals, the Small Business Commissioner, the man appointed by the government to deal with the issue, would be able to compel disclosure of payment terms and impose fines and binding payment plans on tardy payers.

Company boards would also be held accountable for supply chain payment practices for first time with audit committees forced to report payment practices in company annual reports.

Small business advice for dealing with late payments

Get business support right to your inbox

Subscribe to our newsletter to receive business tips, learn about new funding programmes, join upcoming events, take e-learning courses, and more.

Start your business journey today

Take the first step to successfully starting and growing your business.

Join for free